Welcome to the captivating world of financial accounting! Don’t worry. We won’t bore you with complicated jargon or mind-numbing formulas. This article is your ticket to understanding the basics of financial accounting, even if you’ve never donned a green eyeshade or carried a calculator before. Buckle up and prepare for an exciting journey into the realm of numbers and balance sheets!

The Balance Sheet: Discovering Your Financial Snapshot

Imagine a balance sheet as a snapshot of a company’s financial position at a specific point in time. It’s like capturing a photograph that freezes your financial standing, revealing what you own, what you owe, and what’s left for you. Think of it as your very own financial selfie!

Let’s break it down into its essential components:

Assets: Your Company’s Treasure Trove

Assets are the goodies your company possesses. They are the tangible and intangible resources that hold value and contribute to your business’s operations. Think of them as your treasure trove of economic worth.

Assets come in various forms, such as:

- Cash: The shiny coins and crisp bills in your cash register or bank account.

- Accounts Receivable: The money owed to your company by customers who haven’t yet paid their bills.

- Inventory: The products or raw materials you have on hand, waiting to be sold or used in production.

- Equipment: The tools, machinery, and vehicles that enable your business to operate.

- Intellectual Property: The patents, copyrights, and trademarks that safeguard your unique ideas and brand.

Liabilities: The Debts That Lurk in the Shadows

Liabilities represent the debts and obligations your company owes to others. They are the obligations that must be fulfilled in the future, usually involving the payment of cash, goods, or services.

Liabilities can take various forms, including:

- Accounts Payable: The outstanding bills and invoices you owe to suppliers and vendors.

- Loans and Borrowings: The funds borrowed from banks or financial institutions to support your business’s growth.

- Accrued Expenses: Expenses that have been incurred but not yet paid, such as salaries or taxes.

Equity: Your Claim to the Kingdom

Equity represents the residual interest in your company after deducting liabilities from assets. It’s like staking your claim to the kingdom you’ve built. Equity can be thought of as the owner’s or shareholders’ investment in the business.

Equity includes:

- Share Capital: The funds raised by issuing shares to investors.

- Retained Earnings: The accumulated profits your business has retained over time.

Remember, the balance sheet obeys the golden equation: Assets = Liabilities + Equity. It’s all about maintaining balance and harmony within the financial universe of your business!

Income Statement: Unveiling the Showtime of Profit and Loss

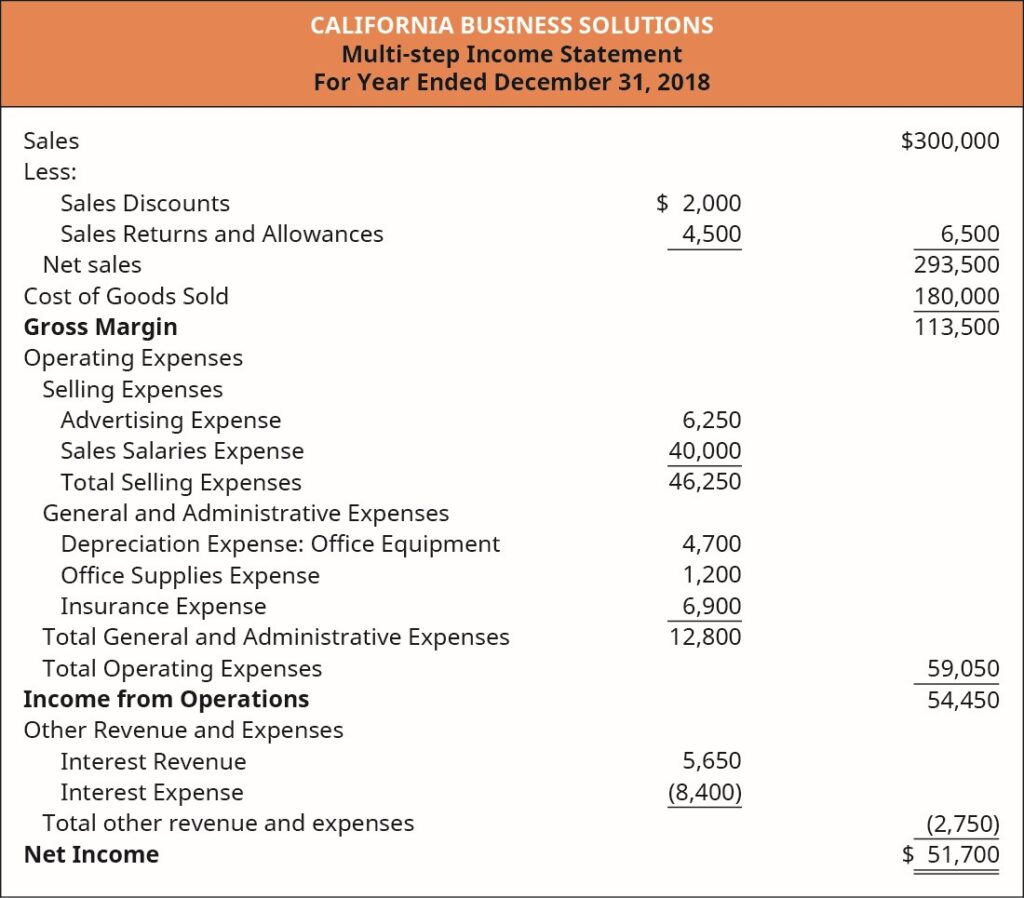

While the balance sheet captures a single moment in time, the income statement paints a dynamic picture of your company’s financial performance over a specific period. It’s like watching a thrilling movie that reveals whether your business is a blockbuster success or facing a plot twist.

The income statement includes:

- Revenue: The money generated from selling products, providing services, or other business activities. It’s the lifeblood of your business, the sweet sound of the cash register ringing.

- Cost of Goods Sold: The expenses directly tied to producing or purchasing the goods you sell. It includes the cost of raw materials, labor, and overhead expenses.

- Gross Profit: The difference between revenue and the cost of goods sold. It’s the first glimpse of the profitability of your core operations.

- Operating Expenses: The costs incurred to run your business, such as rent, utilities, salaries, and marketing expenses.

- Operating Income: The result of subtracting operating expenses from gross profit. It reveals how well your business is performing before considering non-operating factors.

- Non-operating Income and Expenses: The additional sources of income or expenses outside your primary business operations. Examples include interest income, investments, or one-time gains or losses.

- Net Income or Net Loss: The final scorecard, indicating whether your business has made a profit or incurred a loss during the period. It’s the grand finale that determines the fate of your financial story.

Cash Flow Statement: Tracking the Lifeblood of Your Business

The cash flow statement is like a GPS system, guiding you through the twists and turns of your business’s cash inflows and outflows. It tracks the movement of cash, ensuring your business doesn’t run dry.

The cash flow statement consists of three sections:

- Operating Activities: The core operations that generate cash inflows and outflows, such as revenue, payments to suppliers, and employee salaries.

- Investing Activities: The buying or selling of long-term assets, like equipment or investments. It tracks cash flows related to acquisitions or divestments.

- Financing Activities: The sources of cash inflows or outflows from external financing, such as loans, share issuances, or dividend payments.

The cash flow statement helps you assess the liquidity and cash management of your business, ensuring you have a steady stream of funds to keep your operations running smoothly.

By unraveling the mysteries of these financial statements, you’ll gain a deeper understanding of your business’s financial health. These documents will empower you to make informed decisions and navigate the financial landscape with confidence.

Software Solutions: Your Accounting Sidekick

Now that we’ve mastered the basics of financial accounting, it’s time to make your life easier. Let’s explore some incredible software options that can streamline your accounting processes, whether you’re a small business owner or a financial novice.

QuickBooks

QuickBooks is the superhero of small business accounting software. With its user-friendly interface and robust features, it can help you effortlessly manage your finances, track expenses, and generate reports. Say goodbye to those intimidating spreadsheets, my friends, and let QuickBooks save the day!

Xero

Xero, the cloud-based accounting software, is like having an accounting wizard in your pocket. From invoicing and bank reconciliation to inventory management, it has your back. It’s perfect for the tech-savvy business owner who wants financial control at their fingertips.

Conclusion

Financial accounting isn’t just for number-crunching professionals; it’s a vital tool for small business owners and anyone seeking financial literacy. Now armed with this newfound knowledge, you’re well-equipped to decipher financial statements, understand the dance of double-entry bookkeeping, and even harness the power of accounting software.

So, go forth and conquer the financial world, armed with the basics and a touch of accounting magic.